Biotech Accounting

Our biotech and life sciences clients have raised over half a billion dollars in VC financing. Our CPAs and CFOs share our learnings on the best way to do biotech accounting for startups.

When does a biotech company need to start worrying about doing bookkeeping?

If you haven’t been keeping track of your books by the time you raise your first outside money, you need to get your books in order.

We strongly suggest venture backed companies move away from spreadsheets and into an accounting software as soon as possible. It makes most sense to do this right after raising seed funding, if not before.

- Got a bank account for the startup? Start doing your books.

- Connect your bank account to QuickBooks Online (QBO).

- The transactions in the banks account will start flowing into QBO - use QBO to properly categorize these. Note that this can be tricky with some of the expenses that a biotech startup will have, as some should be capitalized and some may need to be recognized across multiple months.

- It also makes sense to get a business credit card associated with the business - not with your personal credit (get a card with no personal guarantee). A dedicated card can connect directly to your business bank account and flow data into QuickBooks. This makes your personal finances easier, and also makes your books cleaner and more accurate. Our recommendations on the best credit cards for life science startups.

Affordable Startup Bookkeeping and Accounting

Check out Kruze's affordable monthly bookkeeping options.

Basic Bookkeeping

Great for pre-revenue, seed-stage companies

Starting at $600 per month Starting at $750 per month

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Pre-revenue companies

- Tax services available

Founder Timesaver

Best for companies starting to scale

Starting at $850 per month Starting at $1,250 per month

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Revenue recognition support

- Monthly call included

- Earlier financial delivery

Premium

Ideal for high-growth, well-funded businesses

- Dedicated accounting manager

- Accrual-basis bookkeeping

- Complex revenue recognition

- Monthly call included

- Support for multiple entities, consolidation

- Support for class / department tracking

Our experts can help you find the right solution for your budget and business needs.

Get in touch with us today to learn more about our monthly bookkeeping options.

5 Steps your biotech company can take to improve grant proposals and grant accounting

Many early-stage biotech startups use grants to help fund their R&D efforts. Developing grant proposals often has a surprisingly detailed finance/accounting component, and many founders are unprepared to articulate the financial implications of their research on a grant proposal. And, after receiving a grant, proper accounting is necessary to correctly track grant expenses and trigger grant payments.

The good news is that Kruze’s team is familiar with many different types of grants that life sciences companies use, and we can likely support your startup’s grant accounting needs!

5 Tips accounting for biotech companies getting grants

- Match your budget to how your bookkeeping categorizes and produces historical financials - you don’t want to have to do complicated math at the end of each month to true up your actual spend against the grant application.

- Store all of your receipts, invoices, etc. in your accounting software - your documentation should be highly organized, and QuickBooks Online allows you to attach expense detail like invoices directly to accounting entries. Your accountant should do this for you, but you should use an expense tracking software or system to make the collection of the receipts as automatic as possible. Lab supplies and materials, R&D consulting services, other professional fees, equipment - make the document collection part of your workflow.

- Track staff time - people expenses will likely be one of the largest items that you budget for in your grant proposal. Recreating these expenses at the end of the month is a waste of time. Invest in a software that lets employees track their time as they go, and set expectations with the team that they need to do a good job using the system!

- Position yourself for timely drawdowns - in your grant application carefully project when you’ll need drawdowns; or if the grant specifies payments at specific moments, you’ll need to have a detailed financial model that helps you manage your cash position. Remember that many grants require reporting your historical books vs. the grant proposal spending, so make sure you are able to close your books efficiently.

- Keep your procedures simple and highly automated - use software, like the bookkeeping and expense management software that we mentioned, to simplify your grant recordkeeping process.

What financial statements do biotech companies need?’

Biotech companies need to regularly produce three major financial statements. These are the Income Statement, Cash Flow Statement and Balance Sheet. Additionally, biotech companies may have other “financial statement adjacent” items that they need to report on to their board or investors. These include items like headcount, projected expenses, progress toward R&D milestones and more.

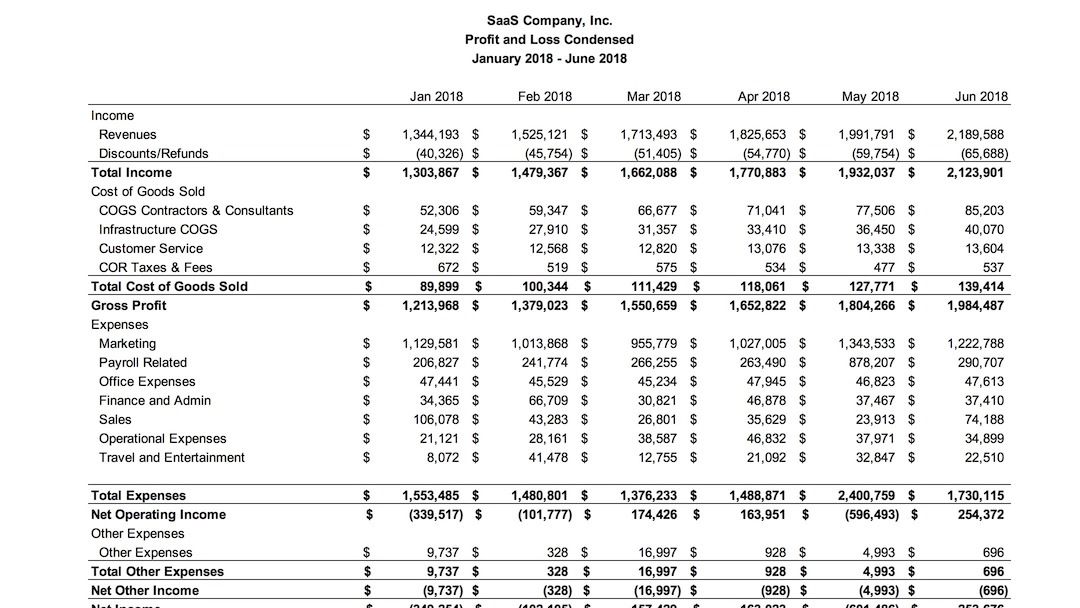

The income statement shows the company’s:

- Revenue (not particularly important for most biotech startups)

- Gross Profit (again, not super relevant)

- Operating Expenses (often broken down by category)

- Net Profit

For R&D stage biotechnology companies, the income statement is a surprisingly “unimportant” financial statement. Many interesting uses of capital - such as equipment spending - are going to be captured on the cash flow statement. However, the income statement does help show many of the costs of conducting research and development in a life sciences organization - in particular, headcount costs.

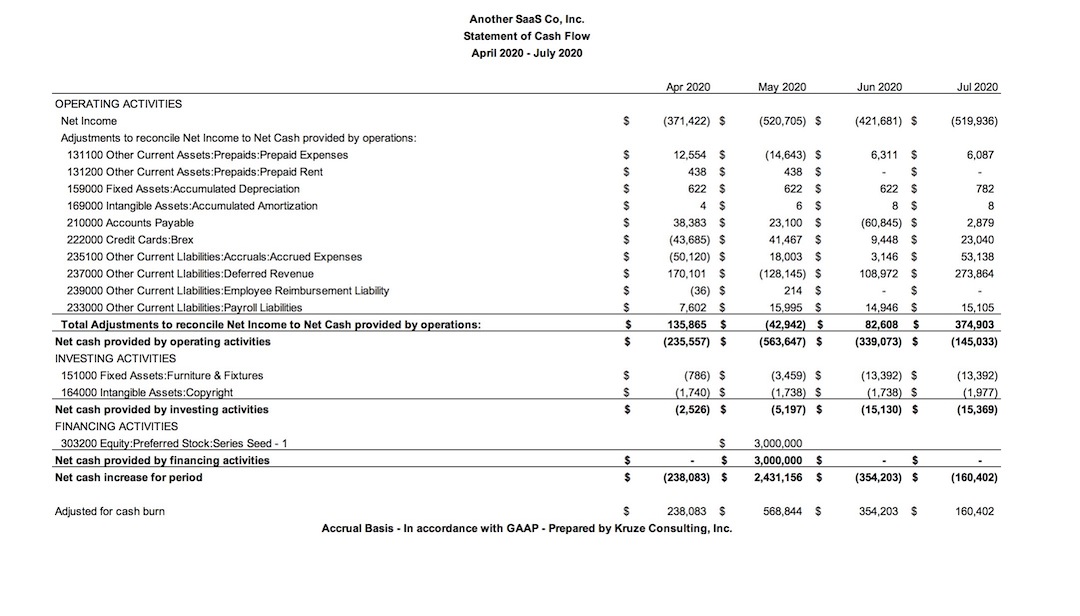

The cash flow statement shows the startup’s:

- Changes in working capital (like changes in payables)

- Operating cash flow

- Investments in equipment (important for many biotech companies)

- Capital raises and loan paydowns

- Net cash flow / change in cash position

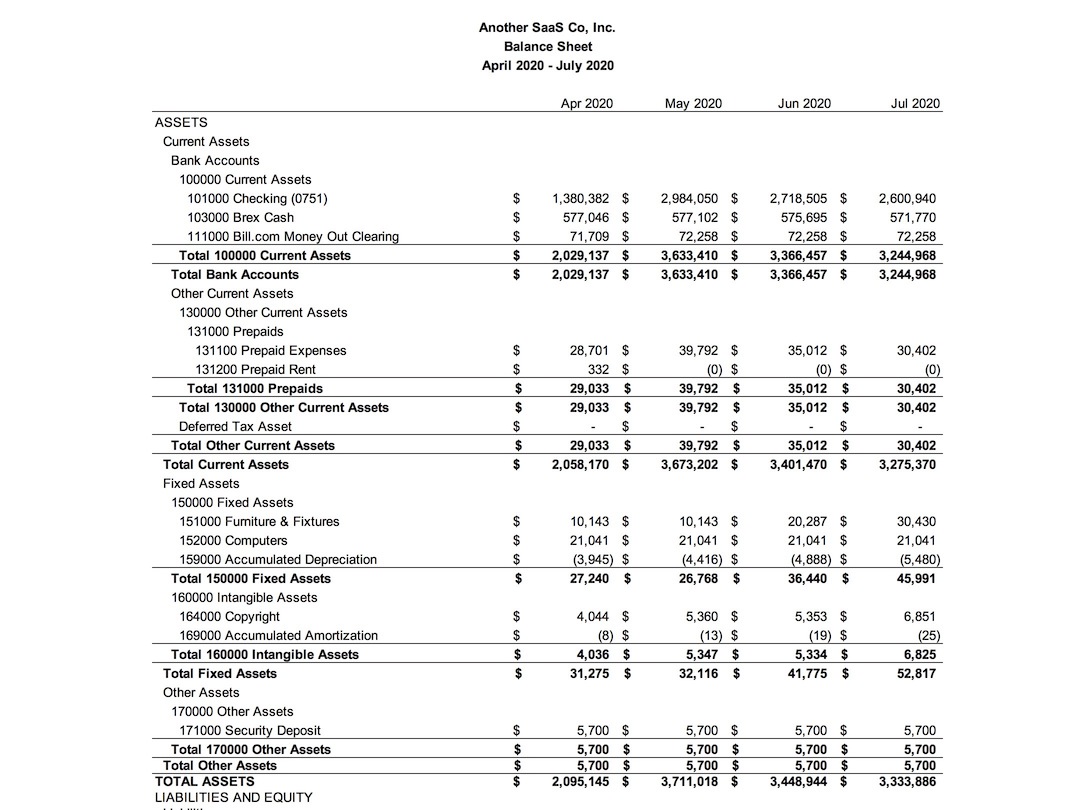

The balance sheet shows:

- Assets

- Cash

- Equipment and capitalized leases

- Other assets buildings, labs, etc.

- Liabilities

- Accounts Payable

- Credit Card liabilities

- Loans

- Equity

- Invested equity

- Retained earnings

The balance sheet for a biotech company is usually dramatically different than a software startup’s, or a traditional business. In particular, biotech expenses may be capitalized - items like research equipment, for example, can be acquired as capitalized leases, can be purchased with manufacturer loans, be bought outright - and all of these have specific accounting implications on the balance sheet.

Organizing Your Expenses

Creating a specialized biotech chart of accounts is important for the financial health and scalability of your biotech company’s accounting and finance. A chart of accounts is how expenses, assets, liabilities, etc. are mapped into your accounting software. This specialized COA addresses the sector’s distinctive accounting needs, from tracking the costs associated with laboratory equipment maintenance to managing expenses for clinical trials. Unlike generic accounting frameworks, a biotech-specific COA enables founders to navigate the complex regulatory landscape efficiently, ensuring compliance while optimizing financial transparency. By categorizing financial transactions in a manner that reflects the unique operational realities of biotech ventures, this tailored COA facilitates more accurate financial reporting and insightful analysis. It may not be necessary to set this up from day one, but eventually, you’ll want to make a the commitment to it.

Kruze is a leading accounting provider to VC-backed biotech startups

Through our work with dozens of funded life sciences startups, we realized that founders like to be able to project their future spending. That’s why we price our bookkeeping services on a set, recurring monthly level - our clients can know what their basic accounting will cost each and every month. The best founders know what they will spend next month, and the month after that. Having their accounting expenses set is one step toward effective cash management for the experienced startup founder.

What to look for in a good biotech accountant

Your biotech startup’s accounting partner should be experienced with the nuances of working with an R&D intensive business. This includes both the basic bookkeeping and complicated tax incentives available to biotech startups.

At Kruze, we combine automated software with experienced controllers and CPAs. Our custom-built, highly automated bookkeeping software works directly with QuickBooks Online. This automation reduces your monthly accounting expenses - and gives you the benefit of your transactions and supporting details all being saved in the industry leading accounting software, QuickBooks. Our accounting team has over 11 years, on average, of experience. Want to learn more about our experience?

Check out our startup accounting dictionary!

Ready to work with a biotech accounting expert?

The best biotech accountants know tax credits for life science startups

There are several tax credits that can help unprofitable, R&D stage, biotech startups reduce their burn rate. Work with an accountant who can help you with both your bookkeeping and tax work, so that you can maximize your government incentives!

Some of the best tax credits for research stage biotechnology startups are the R&D tax credit (calculate your credit here), and several state credits like the California Sales Tax Exemption, the Massachusetts Sales Tax Exemption, and the Maryland Biotechnology Investment Tax Credit. The BEST of these, which should apply to pretty much all pharma/life science startups doing reserach in the USA is the R&D tax credit.

About the R&D tax credit for life sciences companies

The top biotech accountants will be very clear - the best government incentive for biotech and pharma startups is the R&D tax credit. This credit provides practically immediate relief against payroll taxes - taxes all companies with employees in the US pay!

The R&D tax credit can provide up to $250,000 in payroll tax credits - and that amount is increasing to $500,000 for the tax year 2023 thanks to the Inflation Reduction Act of 2022.

What biotech research activities qualify?

- Wages for employees who engage in R&D activities in the US

- Subcontractors conducting R&D in the US

- Supplies directly related to the R&D activities - there are nuances, so work with a good CPA

- Computer Leases/Rentals, which is less common for life science companies

It’s very important to note that the credit is not just payroll, which is why it’s good to work with the accounting team that does your bookkeeping. CPAs like Kruze can not only get you a tax credit for the work your employees do, but can also help make sure you get credit for the R&D expenses that run through your accounting software.

What’s the best accounting system for a biotech startup?

In general, for most startups (biotech included), the best accounting software is QuickBooks Online. However, biotech accounting does introduce some complications that typical software startups will not recognize, and therefore and ERP solution like Netsuite may start to make sense earlier.

The rest of the biotech accounting system

Beyond QuickBooks Online, biotechnology startups will need other fintech solutions within their accounting system. Look for tools that easily integrate with QBO and that automate menial bookkeeping and record keeping tasks. These systems include:

- A startup focused bank like Mercury, FRB, Rho, etc. Look for a bank that knows startups, has stable capitalization, good customer service and in today’s environment - some yield on your cash.

- A automated expense management solution - today the best are bundled with startup credit cards. Biotech companies have a LOT of non-headcount related expenses, and keeping track of them is core to your accounting operations.

- Scaleable payroll - life sciences companies scale quickly, so having a robust, automated payroll system is critical.

- International payroll - many companies hire critical employees and contractors outside of the US; stay compliant with a good international hiring/contracting system.

Written by

Client testimonials

We're huge fans of Vanessa and the folks at Kruze Consulting. They set up our books, finances, and other operations, and are constantly organized and on top of things. As a startup, you have to focus on your product and customers, and Kruze takes care of everything else (which is a massive sigh of relief). I highly highly highly recommend working with Vanessa and her team.

Vivek Sodera

Co-Founder @ Superhuman

Prior to Kruze, as a remote-first team, we were weighed down by a lot of the bureaucracy involved with having a distributed workforce. Kruze has supported us above and beyond basic accounting needs by ensuring we have everything we need to expand and support our team wherever they may be located

Zack Fisch

Pequity's Head of Operations & Legal

Avochato has been growing rapidly in the past year – in fact, too quickly for us to keep up with books, taxes, and budgeting for growth. Partnering with Kruze Consulting has been fantastic to manage, track, and analyze our finances while we continue focusing on building our customer base. Kruze’s team knows what startups need.

Alex De Simone

CEO @ Avochato

Everybody, go to Kruze Consulting. They do a great job. I personally can tell you, they've done a great job for our companies, including Calm.com. I'm sure they’ll do a great job for you.

Jason Calacanis

Angel investor

Consulting, Tax and Valuation Prices

Competitively priced for high-growth companies

Financial Consulting

| Staff Accountant | $120 |

| Senior Staff Accountant | $170 |

| Controller | $200 |

| Senior Controller | $250 |

| Financial Modeling | $400 |

| CFO / COO / VP | $400 |

Tax Advice

| Administrative | $115 |

| Tax Analyst | $175 |

| Senior Tax Analyst | $295 |

| Tax Manager | $395 |

| Tax VP | $495 |

| CEO | $495 |

Startup 409A Valuation

| Pre-Seed/Seed | $2,000 |

| Seed A | $2,500 |

| Seed B | $3,000 |

| Seed C | $3,500 |